20Shift: Your Daily Dose of Insight

Stay updated with the latest trends and news across various domains.

Protecting Your Paycheck: Why Disability Insurance is a No-Brainer

Secure your financial future! Discover why disability insurance is essential for protecting your paycheck and peace of mind.

Understanding the Basics: What You Need to Know About Disability Insurance

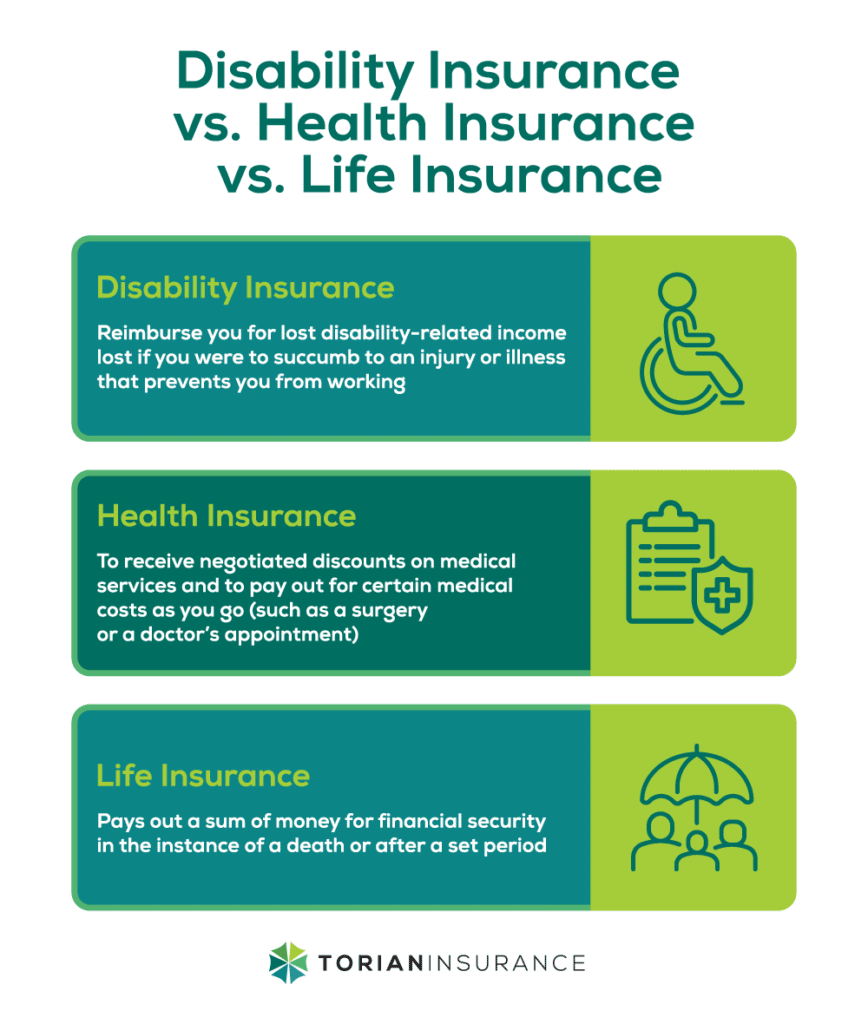

Disability insurance is a vital safety net that protects your income in the event you become unable to work due to injury or illness. It provides a portion of your salary, ensuring that you can cover essential expenses. There are different types of disability insurance policies, including short-term and long-term options. Investopedia provides a comprehensive overview of these types and highlights the importance of understanding your own needs when choosing a policy.

Understanding the key features of disability insurance is also crucial. Policies typically include definitions of disability, elimination periods, and benefit durations. For example, an elimination period is a waiting time before benefits commence, while the benefit duration specifies how long you will receive payments. Reading the fine print can help you avoid surprises later. For more detailed information, refer to the Nolo guide on disability insurance.

How Disability Insurance Can Safeguard Your Financial Future

Disability insurance serves as a critical financial safety net, ensuring that you can maintain your standard of living in the event of an unexpected illness or injury. With the rising costs of living and increasing unpredictability in today's world, having this form of protection is more vital than ever. According to the Social Security Administration, nearly 1 in 4 workers will experience a disability during their working years. Without adequate coverage, a significant portion of your income could be lost, leaving you unprepared for essential expenses such as rent, groceries, and medical bills.

Investing in disability insurance not only provides peace of mind but also serves as a long-term financial investment for your future. Consider this: if you become disabled and can no longer work, your disability policy can replace a portion of your lost income, often ranging from 60% to 80%. This payout can be the difference between financial stability and crisis. For more information on how disability insurance can protect you, visit the National Association of Insurance Commissioners, which provides valuable insights on coverage options and benefits.

Is Disability Insurance Worth It? 5 Key Reasons to Consider

When evaluating the question of Is Disability Insurance Worth It?, it's essential to consider the financial protection it offers against unforeseen circumstances. Disability insurance provides a safety net that ensures you can maintain your livelihood even if an illness or injury prevents you from working. According to NerdWallet, approximately 1 in 4 Americans will experience a disability that lasts longer than a year. This staggering statistic emphasizes the significance of being prepared and highlights why exploring disability insurance is a worthwhile consideration.

Here are 5 key reasons to consider disability insurance:

- Income Replacement: It replaces a portion of your lost income, enabling you to cover living expenses during your time away from work.

- Long-Term Protection: Many policies can provide benefits for several years, safeguarding your financial stability in the long term.

- Peace of Mind: Knowing you have a backup plan can alleviate stress and allow you to focus on recovery.

- Flexibility: Different plans offer various coverage levels and waiting periods to fit your individual needs.

- Rising Healthcare Costs: With medical expenses continually increasing, having disability insurance can help manage those financial burdens effectively, as per Forbes.