20Shift: Your Daily Dose of Insight

Stay updated with the latest trends and news across various domains.

Instant Gratification: Why Instant Payout Systems Are Transforming Your Wallet

Discover how instant payout systems are revolutionizing your finances and unlocking instant rewards—transform your wallet today!

The Rise of Instant Payout Systems: A Game Changer for Your Finances

The rise of instant payout systems represents a significant shift in the way individuals and businesses manage their finances. Gone are the days of waiting days or even weeks to receive payments. With these innovative systems, users can experience near-instantaneous transactions, making financial management smoother and more efficient. For freelancers, gig workers, and small business owners, this means improved cash flow and the ability to reinvest earnings back into their ventures almost immediately. Additionally, with the integration of these systems into various platforms, users are finding more ways to access their money swiftly, enhancing their overall financial agility.

Furthermore, the benefits of instant payout systems extend beyond mere convenience. By leveraging advanced technology such as blockchain and mobile payment solutions, these systems ensure transactions are not only fast but also secure. This security can be a game changer for those wary of traditional banking methods. As more people embrace digital wallets and instant payment options, we can expect a cultural shift in how we perceive and interact with money. Ultimately, adopting these systems could lead to more informed spending habits and improved financial health, making them vital tools in today’s economy.

Counter-Strike is a popular first-person shooter game that pits teams of terrorists against counter-terrorists in various objectives. Players can enhance their gaming experience using strategies and tools, such as a clash promo code to unlock special features. The game has evolved significantly, with several versions and updates, maintaining a dedicated player base worldwide.

How Instant Gratification is Reshaping Money Transfers and Payments

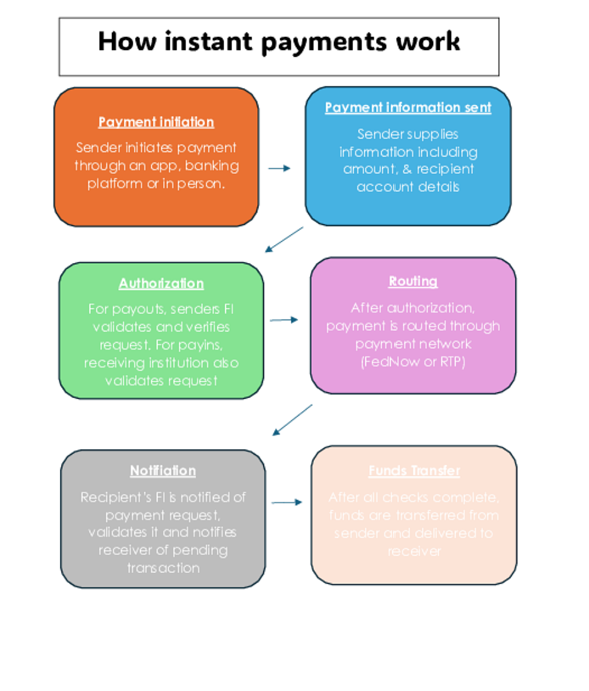

The modern digital landscape is increasingly driven by a desire for instant gratification, and this trend is profoundly reshaping the way we handle money transfers and payments. Consumers today expect not only speed but also simplicity and convenience in their financial transactions. Whether it's sending money to a friend across the country or paying for groceries with a tap of their smartphone, the evolution of payment technologies has made instantaneous transactions the norm. Fintech companies are responding by creating platforms that facilitate real-time payment solutions, thereby satisfying the immediate needs of their users.

Moreover, the rise of apps and digital wallets has further accelerated this shift towards instant gratification, as users can now execute transactions within seconds, without the hassle of traditional banking methods. Payment systems like Venmo, PayPal, and Apple Pay have introduced features that prioritize speed and ease of use, allowing consumers to send and receive money at lightning speed. This growing expectation for immediate service has forced financial institutions to adapt rapidly, leading to innovations such as instant bank transfers and contactless payments, all aimed at meeting the insatiable appetite for quick financial transactions.

Are Instant Payouts Worth It? Understanding the Benefits and Risks

In recent years, the concept of instant payouts has gained significant traction, especially among gig economy workers and freelancers. These immediate payments offer several benefits, such as enhanced cash flow, reduced financial stress, and improved job satisfaction. For those who rely on a steady income to cover day-to-day expenses, the ability to receive funds instantly can be a lifesaver. Moreover, the convenience of accessing earnings right away allows workers to make timely purchases without waiting for the traditional payroll cycle, making instant payouts an appealing alternative.

However, like any financial option, instant payouts come with their own set of risks. One major drawback is the potential for fees associated with immediate disbursement, which can eat into overall earnings. Additionally, the quick access to funds might encourage impulsive spending, leading to financial instability over time. It's essential for individuals considering this model to weigh these risks against the benefits carefully. Ultimately, understanding both sides of instant payouts can help you make an informed decision that aligns with your financial goals.