20Shift: Your Daily Dose of Insight

Stay updated with the latest trends and news across various domains.

Is KYC the New Crypto Casino Bouncer? Let’s Find Out

Discover if KYC is the ultimate gatekeeper for crypto or just a flashy new bouncer. Dive in and see what the hype is all about!

Exploring KYC: The Role of Know Your Customer in Crypto Transactions

Know Your Customer (KYC) protocols play a crucial role in the realm of cryptocurrency transactions, ensuring that the identities of users are verified before they engage in trading or investment activities. In a landscape often characterized by anonymity and lack of regulation, KYC serves as a fundamental layer of security. By implementing KYC measures, crypto exchanges and platforms can mitigate the risks of fraudulent activities, money laundering, and other illicit practices that can undermine the integrity of digital currencies. For users, understanding KYC requirements is essential, as it not only protects their investments but also enhances the overall credibility of the cryptocurrency ecosystem.

The KYC process typically involves collecting personal information from users, such as their name, address, and identification documents. This data is then verified to ensure compliance with regulatory standards. KYC not only helps institutions comply with legal obligations but also fosters a sense of trust among users, as they are assured that the platforms they are using operate within the law. As cryptocurrency continues to gain mainstream acceptance, the significance of KYC will only grow, playing a pivotal role in balancing the need for privacy with the necessity of security in financial transactions.

With the rise of digital currencies, many have turned to a crypto casino for an exhilarating gaming experience. These platforms combine the thrill of traditional gambling with the innovative features of cryptocurrency, offering players unique advantages and anonymity. Whether you're a seasoned gambler or a newcomer, exploring the world of crypto casinos can be both fun and rewarding.

Is KYC Making Crypto Safer or Just a New Barrier?

The introduction of KYC (Know Your Customer) regulations in the cryptocurrency space aims to enhance security and prevent illicit activities. Advocates argue that KYC is crucial for building trust in digital currencies, as it helps verify the identities of users, thereby reducing risks associated with fraud, money laundering, and terrorist financing. By establishing a more transparent ecosystem, KYC practices may pave the way for wider acceptance of cryptocurrencies in traditional financial systems.

However, some critics contend that KYC acts as a new barrier to entry for many users, especially in a domain that initially thrived on anonymity and decentralization. The increased scrutiny can deter potential users who value privacy, leading to a concerning trend where accessibility is compromised. As the debate continues, it's clear that while KYC may enhance security, it also raises questions about user freedom and the foundational principles of cryptocurrency.

How Does KYC Function as a Bouncer for Crypto Exchanges?

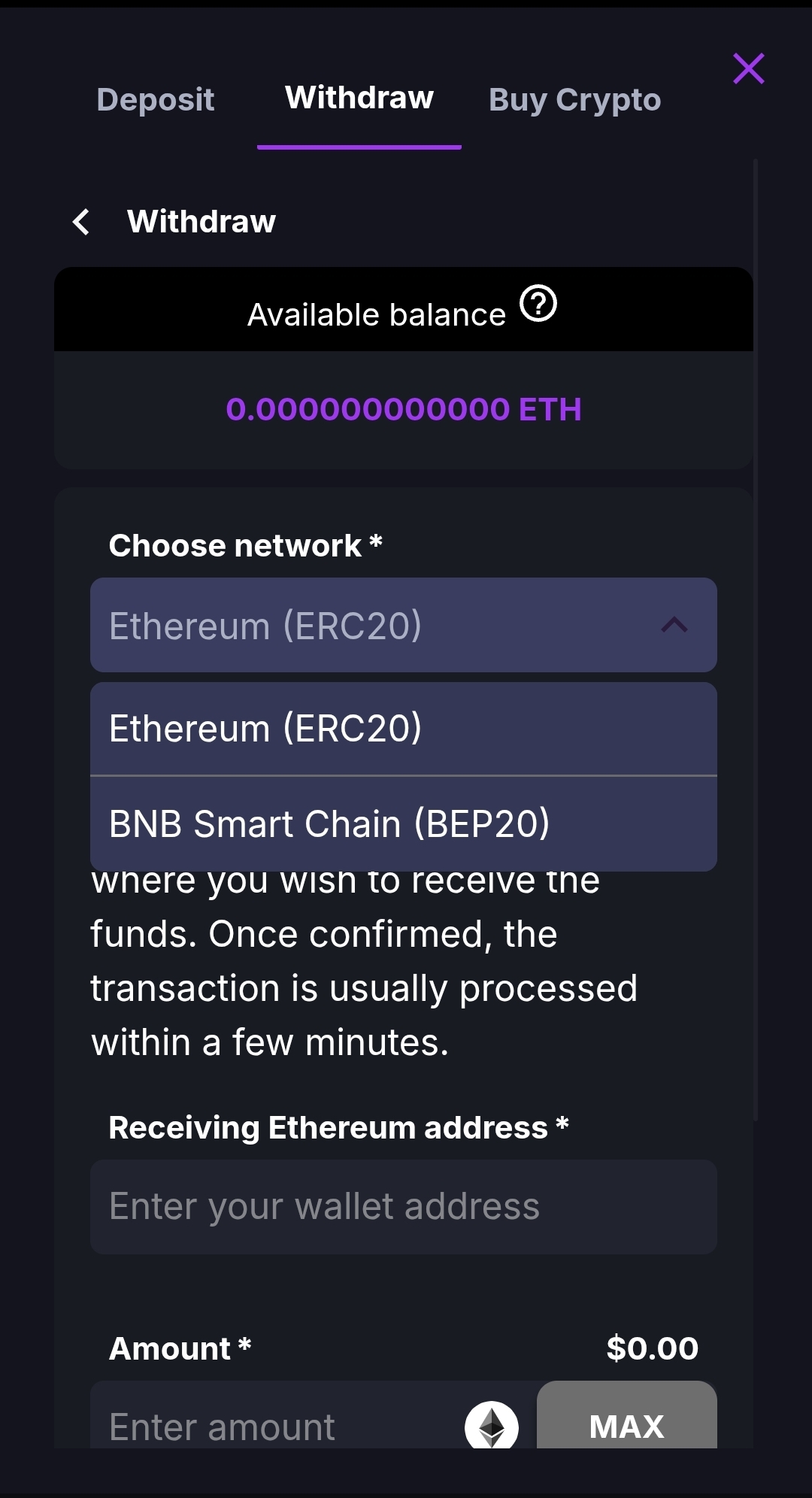

KYC, or Know Your Customer, serves as a critical gatekeeper for crypto exchanges by verifying the identities of users before they can engage in trading activities. This process involves collecting and validating personal information, such as government-issued identification and proof of address. By implementing KYC protocols, exchanges aim to combat illegal activities, such as fraud and money laundering, ensuring that only legitimate users participate in the cryptocurrency market. This not only protects the integrity of the exchange but also fosters trust within the wider financial ecosystem.

Notably, the KYC process functions like a bouncer at a nightclub, determining who is allowed entry based on specific criteria. For instance, exchanges may require users to present documents that clarify their source of funds, which adds another layer of security. While some users may view these requirements as cumbersome, they play a vital role in enhancing the overall safety of the crypto environment. As regulations around cryptocurrency tighten globally, KYC compliance becomes even more essential for exchanges aiming to operate legitimately and secure their position in an increasingly competitive market.